(Credit: Canva Pro)

(Credit: Canva Pro)It’s been an eventful last few years for Environmental, Social, and Governance (ESG), as increasing stakeholder demand for companies to improve their sustainability transparency has transformed the business world, pushing ESG discussions into places they’d never been. Even as 2022 brought some headwinds against ESG, such as the questioning of the place of ESG in investment decisions, the year also brought new ESG disclosure proposals that will impact many companies, in some cases via mandatory reporting requirements. As these proposals go into effect, we’ll see impacts unfold throughout 2023 and beyond, and business leaders need to be ready.

In what follows, we’ll discuss some major regulations and standards emerging, and what to expect over the next couple of years.

In April 2021, the European Commission accepted a proposal for a Corporate Sustainability Reporting Directive (CSRD) to revise the Non-Financial Reporting Directive (NFRD)—the current EU sustainability reporting framework that sets disclosure requirements for non-financial and diversity information by certain large companies. The CSRD also set the stage for the development of specific sustainability reporting standards. In a letter dated May 12, 2021, EU Commissioner Mairead McGuinness formally requested that EFRAG develop ESG standards under the CSRD.

EFRAG published their first exposure draft European Sustainability Reporting Standards (ESRSs) on April 27, 2022. These standards would apply to large EU companies, both public and private, addressed many areas of ESG, including common aspects like greenhouse gas (GHG) emissions and general disclosure requirements, but also aspects of social sustainability, a term describing efforts to create and support healthy places inside and outside company environments, including relationships with communities and workers outside of the company’s own workforce. EFRAG also published a draft standard addressing the management of workers in the value chain, such as suppliers and contractors, who might bear some of the impacts of the company’s operations and included a standard on “affected communities” that tasks companies with assessing how their business operations impact community equity in terms of access to clean air, clean water, and adequate housing. Other draft EFRAG standards task companies with understanding and mitigating their impact on marine life and biodiversity. EFRAG accepted public comments on its draft standards until August 8, 2022.

On November 15, 2022, EFRAG approved the final versions of its EFRS standards, which contain revisions based on the incorporation of stakeholder feedback. In almost the same time frame that EFRAG was approving final ESRSs, the European Parliament adopted the CSRD, which went into effect on January 5, 2023. With CSRD in force, the compliance timeline has begun, starting with the largest affected EU companies, who will need to report data for the financial year 2024 in 2025.

Altogether, the approved ESRSs increase the number of EU companies required to prepare and submit ESG disclosures to approximately 50,000, a significant jump compared to the roughly 12,000 currently reporting However, it’s also important to note that the standards also directly impact some companies located outside the EU, and companies with operations outside the EU that generate a net turnover of €150 million in the EU and have at least one subsidiary or branch in the EU will also be required to provide sustainability reports.

The SEC has a long history of involvement in ESG disclosures, having first provided investors with information about environmental management risks for public companies in the 1970s, and they published guidance in 2010 on disclosure requirements related to climate change. But until recently, the SEC’s guidance resulted in a limited view of what climate risks were material to the organization and more limited corresponding requirements for reporting and disclosure. That’s changing.

SEC published a 2022 proposed rule that would require publicly traded companies, aka “registrants,” to submit climate-related disclosures based in part on the Task Force on Climate-Related Disclosures (TCFD) framework, while considering compatibility with other third-party frameworks such as Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI). Registrants would need to disclose details such as their governance of climate-related risks and relevant risk management processes, how the identified risks are likely to affect their business, and their emissions of Scopes 1,2, and 3 (if material) GHG emissions as defined by the GHG Protocol. Registrants would need to include the information above on registration statements and periodic reports, such as on Form 10-K. The proposed rule would also amend Regulation S-X to require reporting of financial impacts of severe weather events, other transition activities, and identified climate-related costs that accounted for 1% or more of each line item for the fiscal year – this provision is commonly called the “1% rule.”

The public comment period for the proposed rule closed on June 17, 2022. Stakeholders submitted numerous comments to the docket, generally expressing agreement with the need for more and better disclosures and with SEC’s adoption of the TCDF framework but targeting other aspects of the proposal as overreach. For example, many letters from public companies and trade associations took aim at the 1% rule, maintaining that the low materiality threshold would result in oversharing of ESG information that would confuse more than it clarified.

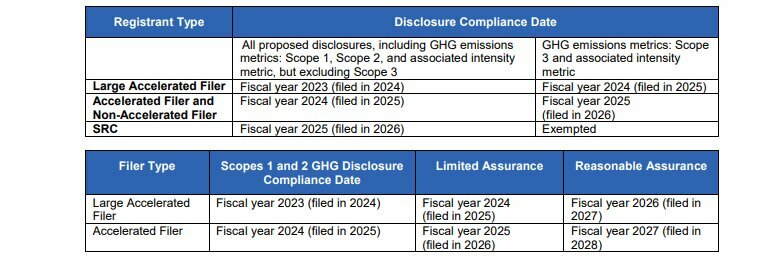

SEC published a fact sheet in 2022 containing the tentative compliance timeline shown below, but that assumed that the final rule was going to be published by December 2022. As of this writing the final rule still hasn’t surfaced, and one explanation for the delay may be provided by recent reports that SEC is considering paring down disclosure obligations. Still, expectations are that SEC will publish the final rule in 2023, and the Fall 2022 Unified Regulatory Agenda indicates a tentative date of April 2023. Public companies should anticipate some level of required disclosures, and even private companies should anticipate that the requirements will ratchet up expectations from stakeholders and value chain partners to improve their own ESG accountability.

(Credit: SEC)

(Credit: SEC)SEC also released other proposed rules in 2022 for financial advisers and investment firms seeking to categorize certain types of ESG strategies broadly and require funds and advisers to provide more specific disclosures in fund prospectuses, annual reports, and adviser brochures based on the ESG strategies. According to the proposed rule, “funds focused on the consideration of environmental factors generally would be required to disclose the greenhouse gas emissions associated with their portfolio investments.” At the time of this writing, we’re also still waiting for finalization of these rules, and there has been similar indication that SEC may refine some of the proposed requirements along the way.

While we’ve been waiting for their final ESG rules, SEC has recently published a report describing its 2023 enforcement priorities.

According to the report, "the Division will continue its focus on ESG-related advisory services and fund offerings, including whether the funds are operating in the manner set forth in their disclosures. In addition, the Division will assess whether ESG products are appropriately labeled and whether recommendations of such products for retail investors are made in investors’ best interest." This is a good indication that the SEC remains determined to increase its oversight of ESG disclosures throughout the economic sector.

To many people, forthcoming regulations like the SEC rules and EFRAG standards might seem like more “noise” in the already cluttered space of ESG disclosures, because of the proliferation of reporting frameworks over the last few years. But the deeper story is that the ESG disclosure space is consolidating, in large part due to efforts by the International Financial Reporting Standards (IFRS) Foundation®, who announced the creation of the International Sustainability Standards Board (ISSB) on November 3, 2021, at the COP26 event in Glasgow, Scotland.

ISSB’s page states that the Board will, “deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities to help them make informed decisions.”

ISSB has been directly fostering consolidation by absorbing other standards and standards-setting bodies into their organization. The Value Reporting Foundation (VRF), which brought together Sustainability SASB and the Integrated Reporting Framework, has now fully consolidated into the IFRS Foundation. This means that oversight of the SASB standards, including various industry-specific standards, has shifted to ISSB.

IFRS S1 proposes that disclosure of sustainability-related risks and opportunities in ISSB standards be centered around the four pillars of governance, strategy, risk management, and metrics and targets.

The draft Climate Standard proposes to require companies to disclose their absolute Scopes — 1 (direct emissions from operations), 2 (from energy use), and 3 (from their broader value chain) greenhouse gas (GHG) emissions—as well as the intensity of those emissions per unit of economic or physical output.

A press release reports that during the October 2022 meeting, ISSB voted unanimously to require companies to disclose all three scopes of GHGs. The unanimous vote is an important detail because it provides more evidence of strong agreement about the importance of these disclosures, including within ISSB itself. The resolution also specifically affirmed the disclosures would include the 15 categories of GHGs detailed in GHG Protocol’s Scope 3 Standard. Based on this vote, ISSB is moving forward on writing these requirements into a final version of the standard.

At the October 2022 meeting, ISSB stated its intention to continue working with agencies such as EFRAG to improve alignment with their standards, and that ISSB standards provide a good foundation for jurisdictional standards-developing agencies to build upon. Additionally, a late 2022 ISSB press release states that ISSB will be modifying at least some of the language in its draft standards to improve alignment with other standards. According to a February 2023 press release, ISSB aims to publish the final versions of both its standards by the end of Q2 2023.

As you can see, big changes are in motion. Here’s a distilled version of key takeaways.

ESG disclosures are central to business. One of the best indications that the industry sees ESG as integral to business is that emerging disclosure regulations, like the proposed SEC rule in the US and forthcoming EFRAG standards in the EU require that companies submit their ESG disclosures in their regular financial reports. One reason for this is that studies have linked better ESG performance to better financial performance and avoidance of major disruptions to business continuity or shareholder value. While some business leaders may protest that ESG isn’t related to business, stakeholders, rule-setting bodies and the data itself disagree.

Reporting frameworks are consolidating. We’ve seen that ISSB has already started consolidating disclosures by obtaining oversight of the SASB standards, building on other existing frameworks, and working with other standards and rule-setting bodies, including EFRAG. Even the SEC in the US is basing its proposed ESG disclosures on the existing TCFD framework and SASB standards.

There is common ground across disclosure frameworks. Since ESG disclosures are consolidating, business and ESG managers would do well to begin their focus with common elements across frameworks. A major commonality concerns climate risk and GHG emissions. Many organizations struggle to report all their GHG emissions, especially Scope 3 sources. Because some GHGs originate from energy consumption, whether from on-site sources (Scope 1) or from utility providers (Scope 2), effective GHG tracking will depend and build upon effective energy tracking. ESG software solutions simplify this task via a common platform for tracking all three scopes of GHGs and alignment of reporting with common disclosure frameworks. ESG software that integrates with your utility provider to collect energy data and apply correct unit conversions and emission factors helps, too.

ESG isn’t just about energy and GHGs. At the same time, don’t convince yourself that energy and GHG management are the only aspects of ESG that matter. Stakeholders increasingly examine a wider range of issues, as we can see from EGRAG’s standards addressing value chain workers, affected communities and biodiversity. Another example is the growing importance of the Science Based Targets Network (SBTN), which builds upon the Science Based Targets Initiative (SBTi) and highlights the connection between climate change and nature/biodiversity loss. issues are intertwined. For example, protecting marine life biodiversity is important to efforts to mitigate global climate change because ocean fauna and photosynthetic microorganisms absorb CO2, and conversely, changes in ocean temperature due to GHG emissions adversely impact marine life. Business leaders looking to do ESG right need to take a wider view of their operations and their impacts, starting with their choice of chemicals, which not only affect air and water discharges and wastes generated but also affect the risks posed to value chain workers and communities throughout their life cycle. Green chemistry is a name given to conscious efforts and analytical tools to make better chemical choices, reduce risks to employees, value chain workers, communities and the environment, and manufacture products that align with circular economy goals of maximizing reuse, refurbishment, and recycling.

Start improving your data and reporting now. Since ESG metrics, especially those tracking climate risks, are becoming increasingly central to business reporting frameworks, businesses hoping to establish and maintain ESG maturity need to start tracking those metrics now. ESG software provides powerful reporting tools aligned with major ESG disclosure frameworks and the data access you need to support better decision-making.

ESG is now a “must have” rather than a “nice to have,” and sustainability and business leaders need to prepare for the challenges and opportunities ahead. Comprehensive ESG software can give you the agility you need to build ESG maturity and competitive advantage in 2023 and beyond.

(Credit: Phil Molé)

(Credit: Phil Molé)Phil Molé is an EHS & Sustainability Expert for VelocityEHS. Phil speaks at numerous conferences and organizations and often presents webinars on EHS management topics. He previously worked as a Global EHS Coordinator for a large manufacturing company, where he developed and facilitated trainings on a variety of subjects and managed the company’s ISO/OHSAS certifications. Phil has also worked as an environmental and safety regulatory consultant for approximately 13 years.

Phil's professional accreditations and memberships include: National Institute of Occupational Safety and Health (NIOSH) Traineeship from 1995 to 1997, American Society of Safety Professionals (ASSP), National Association of Environmental Managers (NAEM), OSHA 30-hour training (2012) and ISO/OHSAS Internal Auditor training (2012).